10k Words | November 2022

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

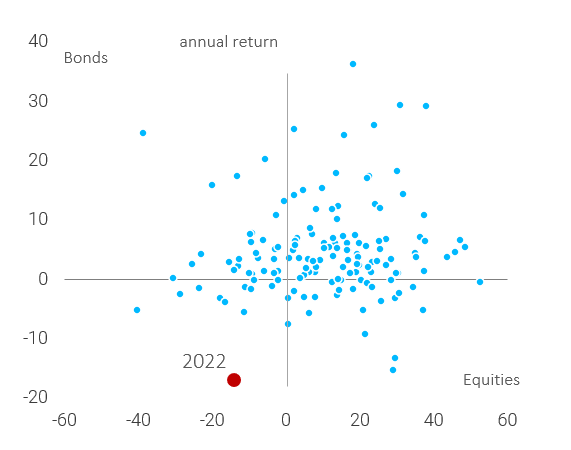

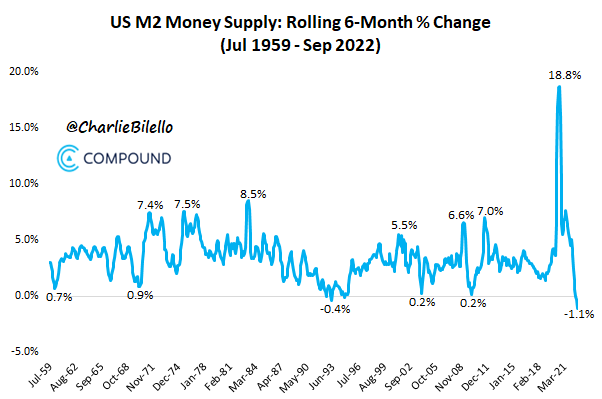

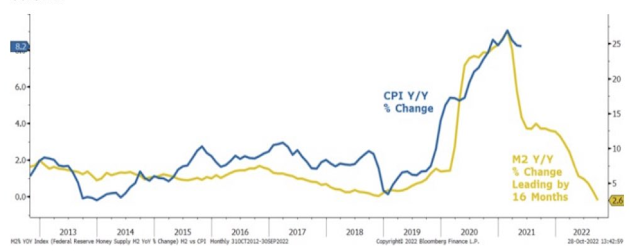

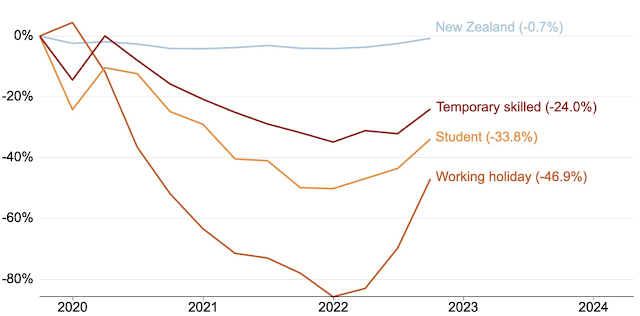

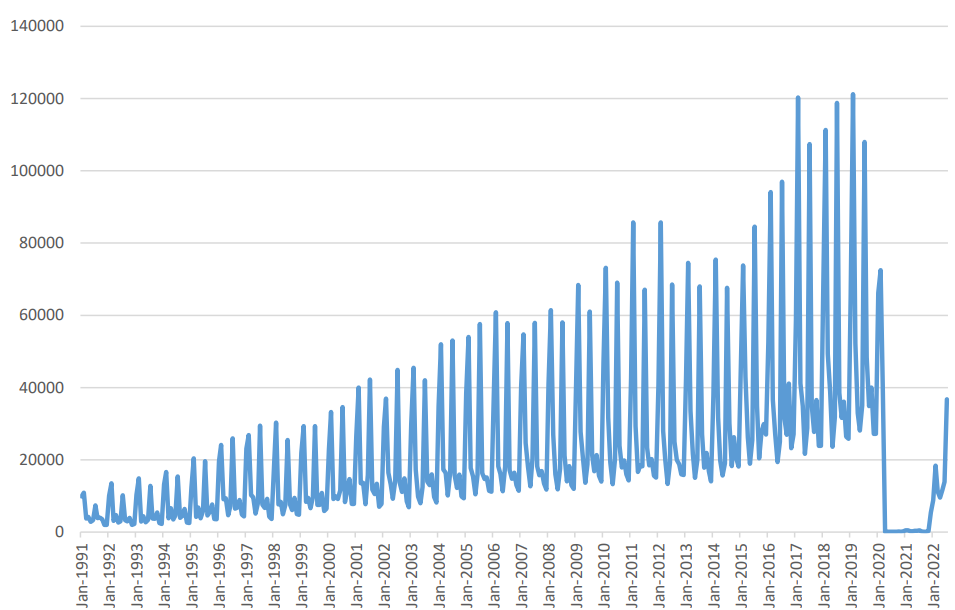

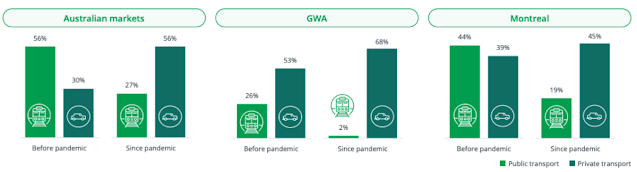

There hasn't been a year quite like this one for investment markets - just look at where @darioperkins plots 2022's returns. While we are sticking with that theme, CNBC tallies $US3 trillion in lost market cap from just seven companies in one year. As a valuation check, Amazon is now trading well below its long-term average EV/EBITDA multiple - while Apple remains above its own. With the "M2" measure of money supply in the US plunging the most on record in a six month period, as highlighted by @CharlieBillelo, Morgan Stanley chartered the historical correlation between M2 and inflation; and True Insights looked at the correlation with stock valuations. An exploration of the pre-and-post COVID worlds has us looking at Australian temporary visas through Grattan Institute's chart, student arrivals in Australia via Pac Partners and finally, a significant shift in communter preferences that suits toll road operator Transurban just fine.

Annual US bond and equity returns since 1870

Source: @darioperkins

$US3 trillion lost in seven companies in one year

Source: CNBC

Forward EV/EBITDA of Amazon and Apple

Source: Equitable Investors, TIKR

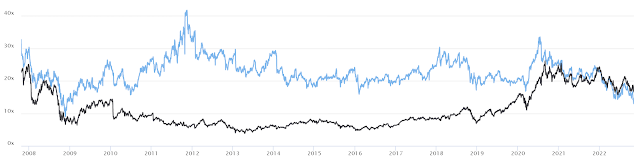

US "M2" money supply experienced its largest decline over a six month period on record

Inflation relative to changes in the “M2” money supply for the United States

Source: Morgan Stanley, BloombergS&P 500 Forward PE change relative to changes in “M2” money supply

Source: True InsightsChange in temporary visa-holders in Australia since pre-COVID

Source: Grattan Institute

Student arrivals per month into Australia

Source: ABS, PAC Partners

Preferences for commuting mode before and after COVID

Source: Transurban