10K Words - January 2022

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

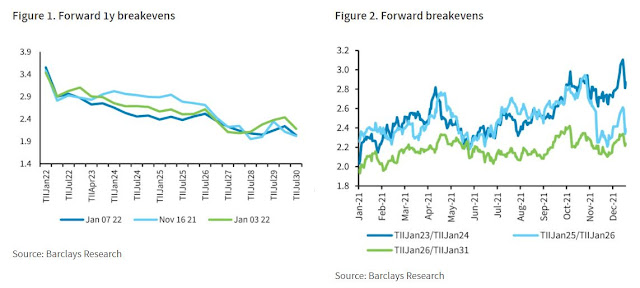

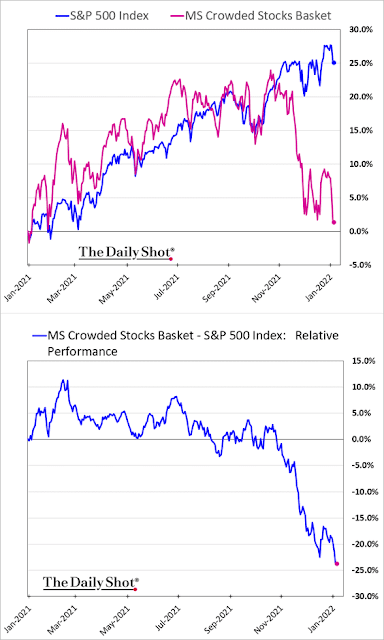

Happy New Year to all! There's plenty of chart action in January covering inflation and interest rates. The implied probability of a Federal Reserve rate hike in March 2022 of at least 25 basis points has surged, as @charliebilello highlighted on Jan 6 (and had to update for a further surge a day later). Barclays set out the break-even rates (break-even inflation is the difference between the nominal yield on a fixed-rate investment and the real yield on a similar inflation-linked investment). On equities we see "crowded trades" and retail sentiment take a dive, courtesy of Morgan Stanley and @lizannsonders. Indeed Hiring Lab provides us a little insight into why unemployed Americans aren't hunting for work with urgency. Meanwhile, the number of Australians thinking this year will be better than last has slumped according to a Roy Morgan poll.

Federal Reserve Rate Hike Probabilities (Jan 6, 2021)

Source: @charliebilello

Federal Reserve Rate Hike Probabilities (Jan 6, 2021)

Source: @charliebilello

Break-evens on inflation-indexed bonds

Source: Barclays via Bloomberg

Collapse in "Crowded Stocks"

Goldman Sachs Retail Sentiment Index

Source: Ann Sonders

Why unemployed aren't showing urgency to find a job

Source: Indeed Hiring Lab

Only 37% of Australians expect 2022 will be ‘better’ than 2021 – down 22% points on a year ago

Source: Roy Morgan