10k Words | September 2022

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

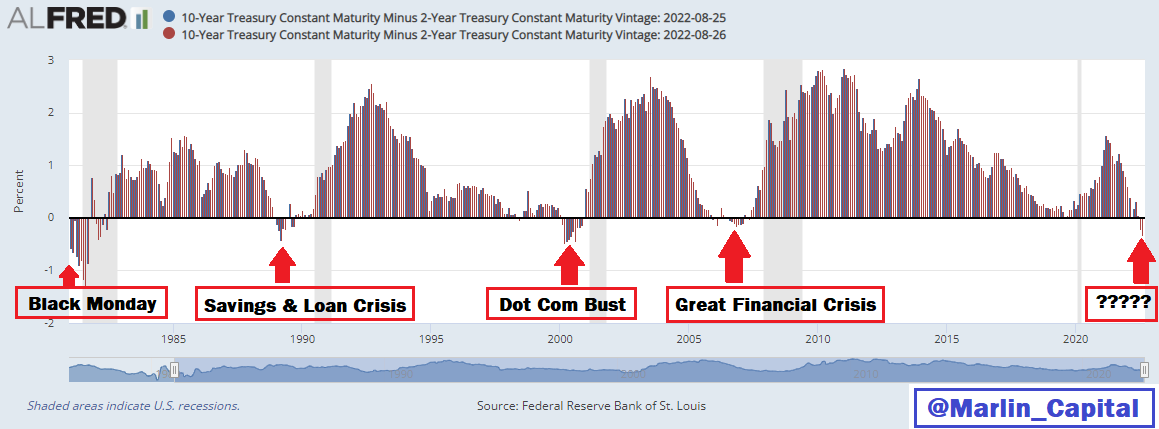

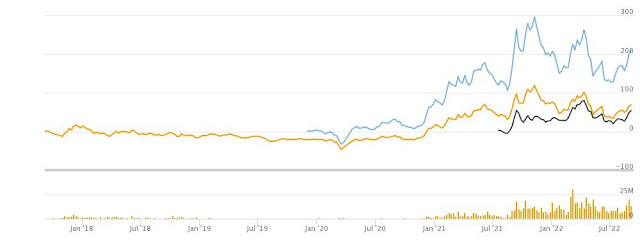

Earnings season on the ASX has come to a close with a historically low number of downgrades on the FY22 numbers, as tracked by Wilsons, but more downgrades than upgrades to EPS and dividend guidance for FY23, based on Evans & Partners' numbers. The one year return on Bloomberg's benchmark for the bond market is down 19% over the past 12 months. While the Australian yield curve is sloping upwards, the US yield curve is currently inverted. An inverted yield curve has historically led to some type of "break" in the system, @Marlin_Capital warns. But the inflation data is potentially turning - Yardeni highlights plunging US gasoline prices. Given the European situation, nuclear power and uranium are seeing a revival of sorts, at least with Japan revisiting its stance. Uranium equities have been advancing and the Washington Post ran a Blooomberg piece highlighting the unsavoury sources of current uranium supply. Taking a look at equities, Bespoke's optimistic take on the June half-year's poor showing is that such a poor first six months is typically followed by 12 months of 20%+ returns for the S&P 500. We thought it was interesting how closely the Grayscale Ethereum Trust has traded in comparison with the ARK Innovation ETF - a speculative cryptocurrency vehicle alongside a high growth tech investment vehicle. And potentially adding some colour to that is Visual Capitalist's charting of the demise of long-term investing.

Aggregate ASX earnings downgrades announced over course of 12 month reporting cycle

Net guidance upgrades for FY23f for the S&P/ASX 200

Source: Evans & PartnersBloomberg Global-Aggregate Total Return Index Value Unhedged USD

Source: RBA

Australian and US yield curves

Source: worldgovernmentbonds.com

An inverted yield curve has historically led to some type of "break" in the system

Source: @Marlin_Capital, Federal Reserve of St Louis

US gasoline priced have plummeted as consumption is reduced relative to a year earlier

Source: Yardeni ResearchNorth American uranium ETFs on the rise (URA, URNM, U.U)

Source: TIKR, Equitable InvestorsAuthoritarian nations dominate the world's uranium production

Source: Washington Post / Bloomberg

S&P 500 has been up at least 22% in the year following prior 20%+ two-quarter drops

Source: Bespoke

Grayscale Ethereum Trust (orange) and ARK Innovation (green) moving together

Source: TIKR, Equitable Investors

The average holding period of shares on the NYSE has fallen to new lows

.png)