10k Words | June 2022

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

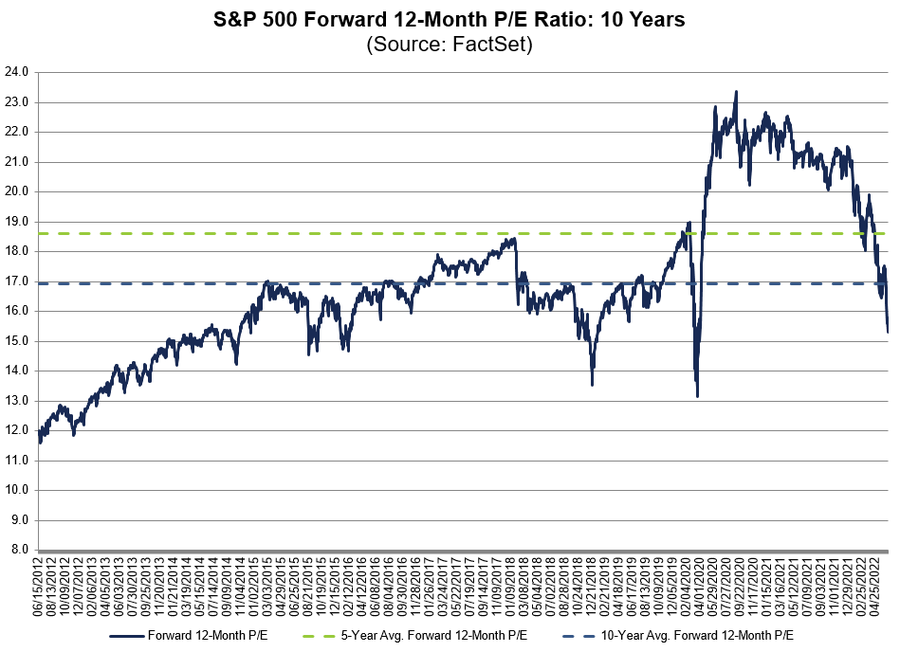

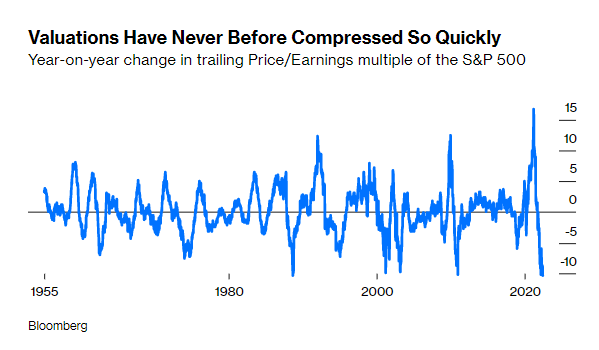

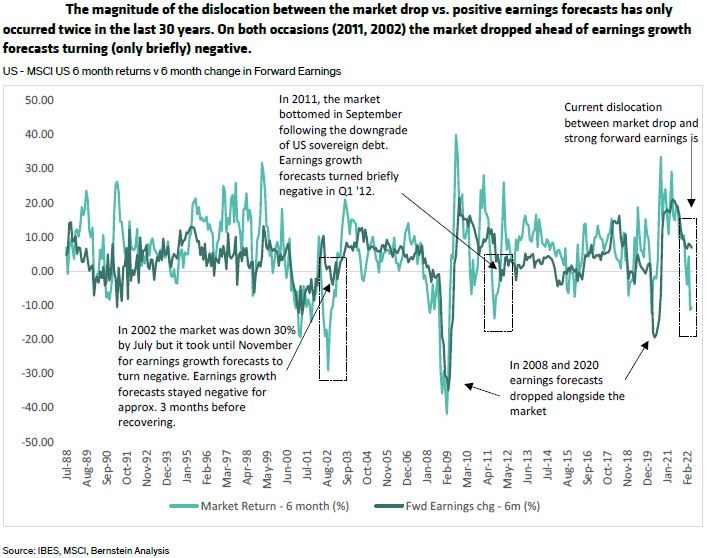

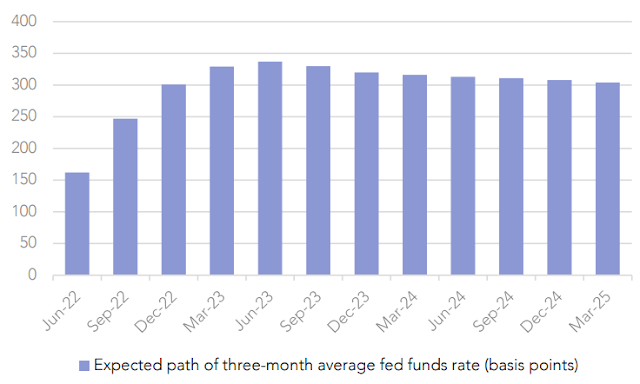

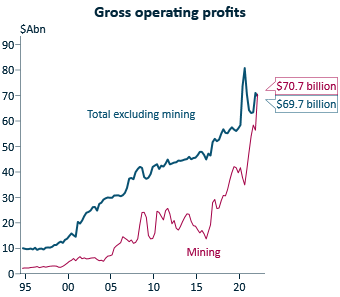

Price-to-Earnings multiples have been crunched in the calendar year to-date, as FactSet and strategist Christophe Barraud chart - but that begs the question posed by Sanford Bernstein - does this imply earnings expectations will be cut? Global equity capital markets volumes have dropped more than market indices, Equitable Investors highlights, while there are plenty of companies in need of fresh cash. Below-trend economic growth and above-trend inflation is the widely held consensus view of the economic backdrop from the Bank of America global fund manager survey. Off the back of that, the market is expecting the Fed cash rate to settle at ~3%, Wilsons calculates. Back in Australia, ANZ-Roy Morgan Consumer Confidence is strikingly low amid all the talk of inflation and interest rates - search terms that have surged on Google Trends. IFM highlights that Australian mining profits have for the first time exceeded profits in all other non-finance sectors combined.

S&P 500 Forward PE over 10 years

Source: FactSet

S&P 500 trailing PE since 1955

Source: Bloomberg, @C_BarraudAre earnings forecasts about to be downgraded?

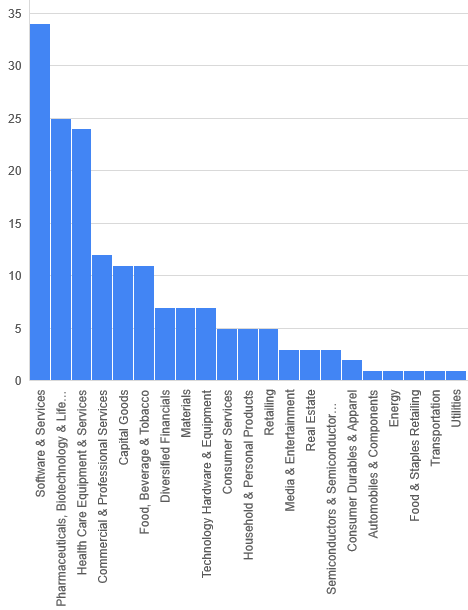

Global Equity Capital Markets ($US)

No, ASX-listed cash burners with 12m or less cash at last reported burn-rate

Source: Equitable Investors

Source: BofA Global Fund Manager Survey (June 2022)

Expected path of Federal Reserve cash rate

ANZ-Roy Morgan Consumer Confidence

Australian web searches for "inflation" (blue line) and "interest rates" (red line)

Australian Gross Operating Profits

Source: ABS, IFM