10K Words - February 2022

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

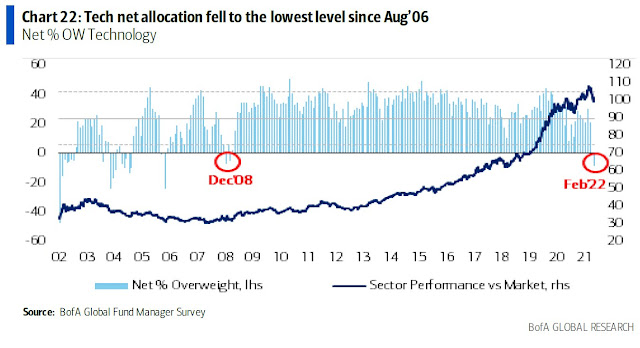

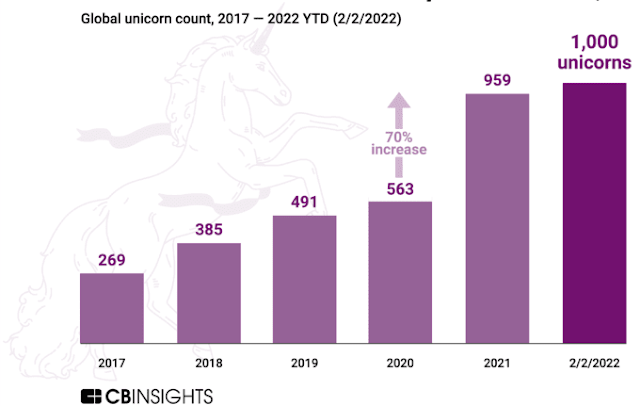

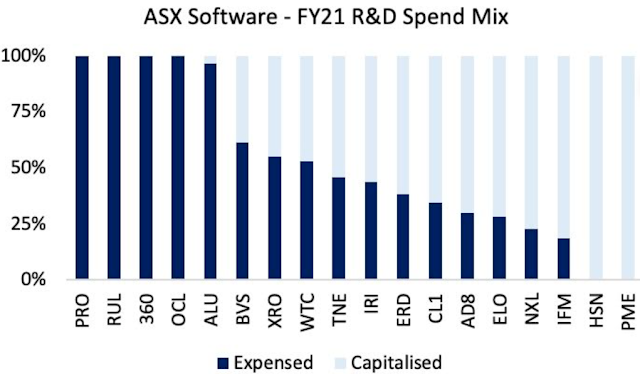

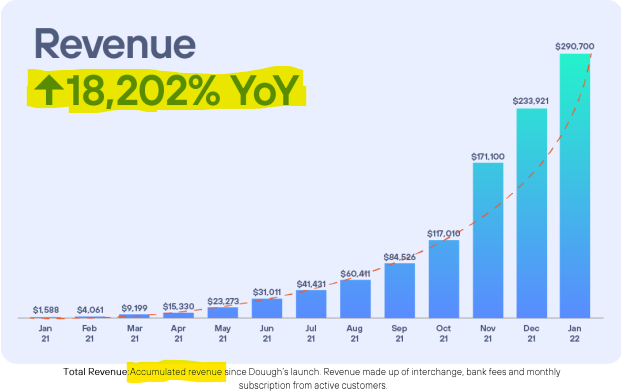

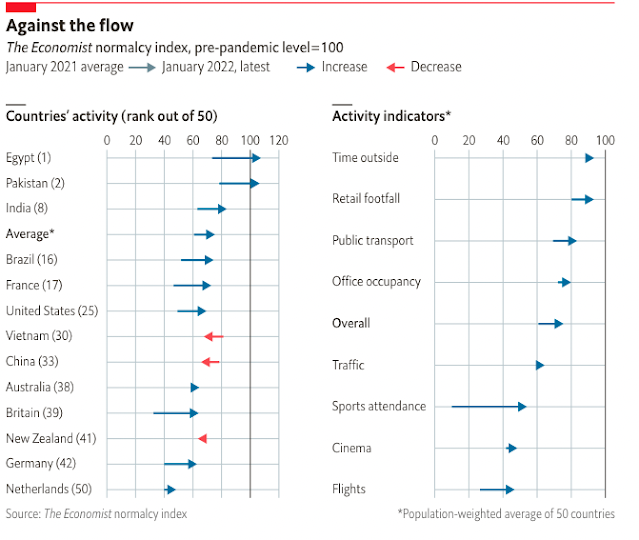

You may have noticed that the tech sector has been under pressure lately. Bank of America's monthly fund manager survey shows allocations to the sector are at the lowest point since 2006 - yet in the unlisted world CB Insights has tallied up a surge in "unicorns" to 1,000! Totus Capital made a great point on the significant dispersion between different tech companies' accounting treatment of R&D spend. And ASX-listed fintech Douugh's "accumulated revenue" chart, as highlighted by @lukewinchester9, was definitely an innovative approach to presenting financials. On the COVID-19 front, Bloomberg shows global air traffic is still less than half pre-pandemic levels, while The Economist shows most countries trending back towards "normalcy" - with China a notable exception.

Tech net allocation at lowest level since 2006

Source: Bank of America (via @daniburgz)

Huge differences in how ASX software companies account for R&D spend

Source: Totus, livewiremarkets

Accumulated revenue chart by ASX-listed Douugh (DOU)

Global air traffic less than half pre-COVID level

Source: BloombergThe Economist's "Normalcy Index"