10k Words - February 2021

Apparently, Confucius didn’t say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

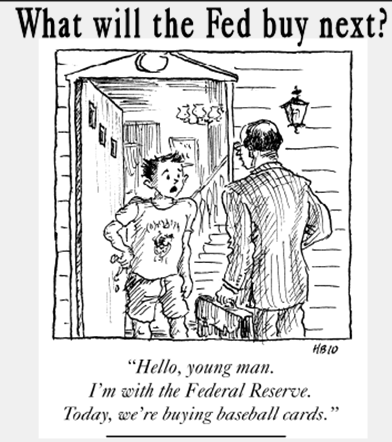

A new research paper found that when retail traders on Robinhood buy a stock, it tends to underperform over the next three to 20 days; looking at some of the craziness of the times we have surging margin debt (relative to GDP) via TheFelderReport.com; and the performance of the most shorted stocks on January 28 via Bespoke. Grant's Interest Rate Observer offers up a chuckle on the extent to which the Fed will go to provide liquidity. Robeco's valuation metrics and Goldman Sach's Risk Appetite Index are reflective of how markets continue to buy risk in this environment. Consistent with the risk appetite, small caps are expected by fund managers BAML surveyed to outperform. Finally, we take a look at how US cannabis ETFs have recovered, particularly in the wake of the GW Pharmaceuticals takeover, with ASX-listed players lagging.

Zero-Commission Individual Investors, High Frequency Traders, and Stock Market Quality

Source: Zero-Commission Individual Investors, High Frequency Traders, and Stock Market Quality, Eaton Green et al [Feb 2021]

US Margin Debt-To-GDP

Russell 3,000 performance by level of short interest on Jan 28, 2021

What will the Fed buy next?

MSCI 12 Month Forward PE

Risk Appetite

Small caps expected to beat large caps

US cannabis-focused ETFs have surged in recent weeks

Performance of select ASX-listed cannabis stocks