10k Words - June 2020

Apparently, Confucius didn’t say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

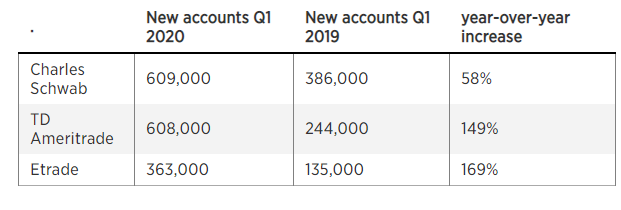

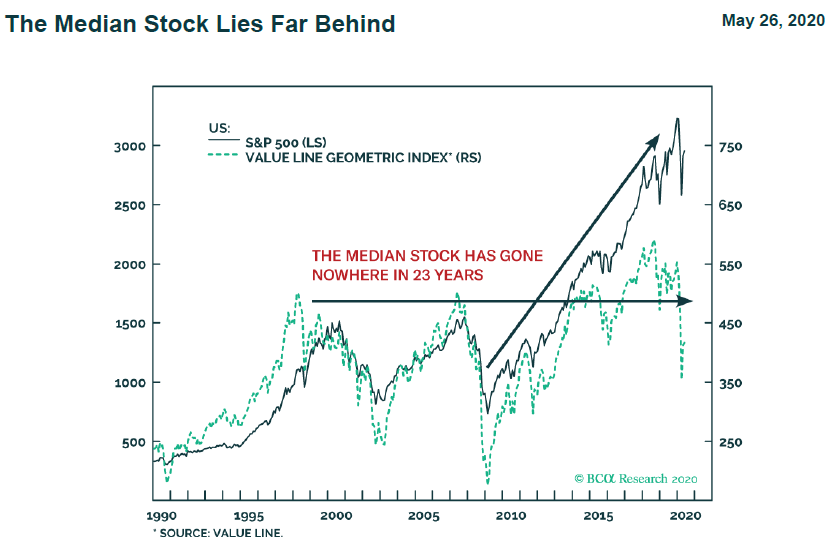

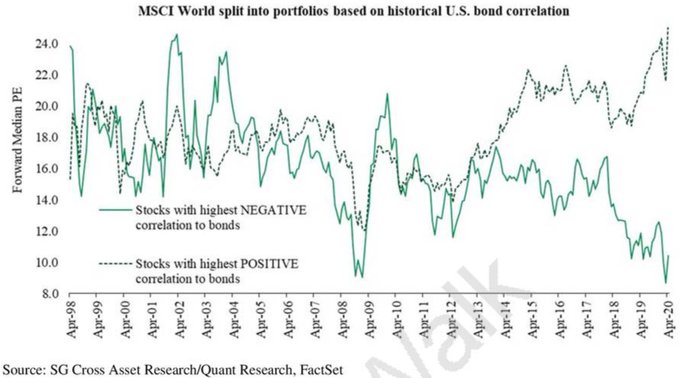

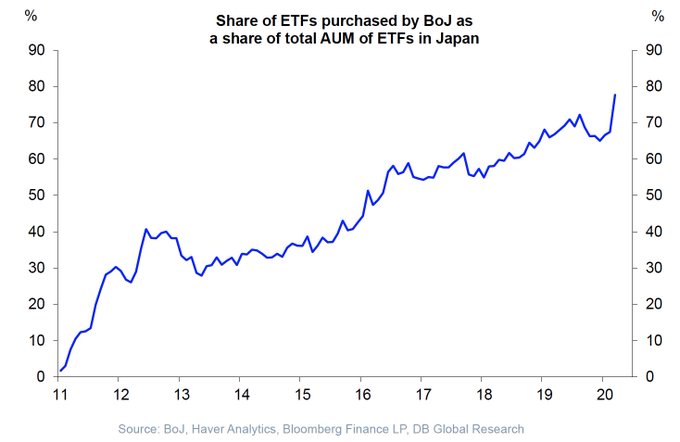

On a day where the equities market is pulling back, we look at a snapshot of the surge in activity amid COVID-19 from small traders on discount broking platforms and "free" trading app Robinhood, via CNBC. Yet professional investors surveyed by BAML are holding the highest level of cash since the 9/11 terrorist attack. Leading into this selling, Evans & Partners' highlights record valuations for the ASX. Back to the US, we see via ValueLine how despite strong equity markets the median stock has gone nowhere for 23 years; while Greenlight Capital highlighted SocGen research that shows a significant valuation spread between stocks that correlate with bonds and those that don't. Where can central banks go from here? In Japan, the central bank has bought ~ 80% of ETFs. Over to consumers, where a survey in China showed continuing caution through to the end of April. Data from ASX-listed payments group Tyro, showed a similar trend in Australia at that time but by June transaction values were up year-on-year!

Surge in activity on "Free" trading app Robinhood amid COVID-19 pandemic

Source:CNBC, Robinhood, Counterpoint

Source: Evans & Partners

Source: Evans & Partners

Source: @jsblokland, Value Line

Source: Greenlight Capital, SG Cross Asset Research

Source: @Schuldensuehner, BOJ, Haver Analytics, Bloomberg, DB Global Research

Source: company

On a day where the equities market is pulling back, we look at a snapshot of the surge in activity amid COVID-19 from small traders on discount broking platforms and "free" trading app Robinhood, via CNBC. Yet professional investors surveyed by BAML are holding the highest level of cash since the 9/11 terrorist attack. Leading into this selling, Evans & Partners' highlights record valuations for the ASX. Back to the US, we see via ValueLine how despite strong equity markets the median stock has gone nowhere for 23 years; while Greenlight Capital highlighted SocGen research that shows a significant valuation spread between stocks that correlate with bonds and those that don't. Where can central banks go from here? In Japan, the central bank has bought ~ 80% of ETFs. Over to consumers, where a survey in China showed continuing caution through to the end of April. Data from ASX-listed payments group Tyro, showed a similar trend in Australia at that time but by June transaction values were up year-on-year!

Online broker new account openings surge amid COVID-19 pandemic

Source: FactSet, CNBCSurge in activity on "Free" trading app Robinhood amid COVID-19 pandemic

Source:CNBC, Robinhood, Counterpoint

Fund managers holding highest level off cash since 9/11 terrorist attack

Source: BAML Global Fund Manager Survey, May 2020

Source: BAML Global Fund Manager Survey, May 2020

ASX 200 PE at extreme level

Source: Evans & Partners

Source: Evans & Partners

Median US stock has gone nowhere for 23 years

Source: @jsblokland, Value Line

Stocks that correlate with bonds trade on 24x PE; stocks that don't trade on 8x

Source: Greenlight Capital, SG Cross Asset Research

Bank of Japan propping up stocks (% of ETFs purchased by the central bank)

Survey of Chinese consumer intentions

Source: Evans & Partners

Tyro Payments trading update shows return to growth in June

Source: company