10k Words - May 2020

Apparently, Confucius didn’t say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

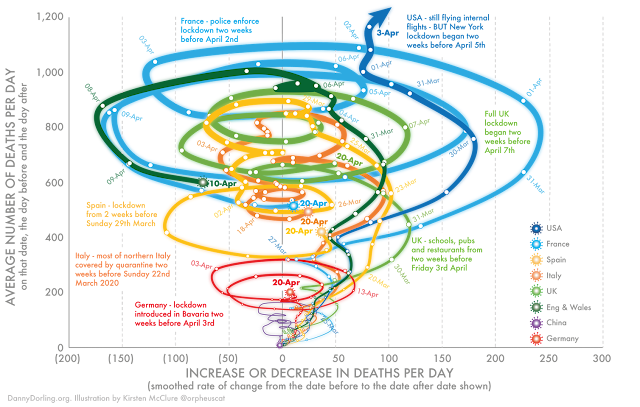

We had to give you something on coronavirus - so it is the most complex infographic we've seen, from DannyDorling.org, then its over to US bonds, where yields are so low, Bloomberg highlights they imply some belief that the Federal Reserve will move to negative rates. From government bonds we move to high-yield (or junk) where rates have surged and Goldman Sachs forecasts a spike in defaults. What happens in equities when the spread on high yield bonds expands? Verdad Capital shows US small cap value starts to perform and charts the significant valuation spread between the cheapest and most expensive. Finally, Macquarie maps out the decline in Australian EPS growth we explored last month.

Source: DannyDorling.org

Source: Bloomberg

Source: Goldman Sachs, AFR

Source: Verdad Capital

Source: Verdad Capital

Source: Macquarie Research

We had to give you something on coronavirus - so it is the most complex infographic we've seen, from DannyDorling.org, then its over to US bonds, where yields are so low, Bloomberg highlights they imply some belief that the Federal Reserve will move to negative rates. From government bonds we move to high-yield (or junk) where rates have surged and Goldman Sachs forecasts a spike in defaults. What happens in equities when the spread on high yield bonds expands? Verdad Capital shows US small cap value starts to perform and charts the significant valuation spread between the cheapest and most expensive. Finally, Macquarie maps out the decline in Australian EPS growth we explored last month.

Charting Coronavirus increase in deaths per day v average

Treasury Yields Hit a New Low in US

Source: Bloomberg

Global central bank purchases driving improved yields relative to the risk-free rate

The images that were originally presented here have been removed at the request of Fross Zelnick Lehrman & Zissu, P.C, representing Citigroup Inc, and claiming that presenting these images here "is creating the false impression that our client is affiliated with or endorses the Infringing Site and its services, or that our client is otherwise connected with the Infringing Site".

High-yield bonds default rate

Returns on US small-value stocks are higher when high-yield spreads blow-out

Source: Verdad Capital

Valuation spread between cheapest & most expensive decile of US equities (using free cash flow yield)

Source: Verdad Capital

US debt/GDP by sector (%) v. yields (%)

The images that were originally presented here have been removed at the request of Fross Zelnick Lehrman & Zissu, P.C, representing Citigroup Inc, and claiming that presenting these images here "is creating the false impression that our client is affiliated with or endorses the Infringing Site and its services, or that our client is otherwise connected with the Infringing Site".

Australian Market EPS growth profile (%)

Source: Macquarie Research