10k Words - Feb 2020

Apparently, Confucius didn’t say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

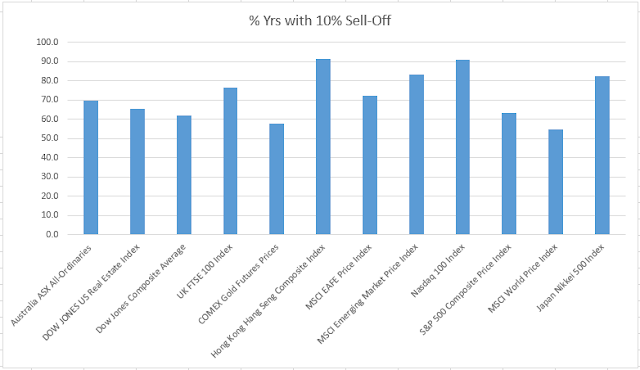

We're in the midst of one of the larger pull-backs in global equiies for some time (on Monday the S&P 500 Index plunged the most since February 2018 according to Bloomberg) so we'll get straight to the matter at hand - alphaarchitect sets out for us how often the equities market falls 10% in a year (~70% of the time for the Australian equities benchmark) and how often a 5% sell-off snowballs to 20% (~13% in Australia). Moody's puts forward a case that higher default rates on high yield corporate debt would be a signal for an equities "purge". With coronavirus or

COVID-19 dominating market fears, Morgans shows short interest in the ASX's travel sector has scaled up. And while COVID-19 has brought fears of an economic slowdown to the fore, CBRE's survey of real estate investors showed the economy was already perceived to be the greatest challenge for 2020. We then sink our teeth into the impact of "FANG" stocks on US market valuation and the relative re-rating of growth and quality stocks compared to those labelled as "value" (all labels we don't necessarily agree with - why can't a stock be good quality and good value because off its growth?), thanks to Yardeni Research, Gavekal and SG.

Percentage of years in which a market features a 10% sell-off

Source: Alpha Architect

Percentage of the time that a 5% sell-off becomes 20%

Source: Alpha Architect

High yield default rates of 7.5% or higher were joined by a median -23% purge in the market value of US equities from their previous high

Source: Moody's

Short interest in the ASX travel sector has increased

Source: Morgans

The biggest challenges facing real estate investors in 2020

Source: CBRE

S&P 500 Forward PE with and without "FANG" or "FAANGM" stocks

Source: Refinitiv, Yardeni Research

Relative valuation of "growth" v "value" in the US - based on earnings yield

Source: Gavekal

"Quality" stocks re-rated relative to "value" stocks

Source: SG Cross Asset Research

We're in the midst of one of the larger pull-backs in global equiies for some time (on Monday the S&P 500 Index plunged the most since February 2018 according to Bloomberg) so we'll get straight to the matter at hand - alphaarchitect sets out for us how often the equities market falls 10% in a year (~70% of the time for the Australian equities benchmark) and how often a 5% sell-off snowballs to 20% (~13% in Australia). Moody's puts forward a case that higher default rates on high yield corporate debt would be a signal for an equities "purge". With coronavirus or

COVID-19 dominating market fears, Morgans shows short interest in the ASX's travel sector has scaled up. And while COVID-19 has brought fears of an economic slowdown to the fore, CBRE's survey of real estate investors showed the economy was already perceived to be the greatest challenge for 2020. We then sink our teeth into the impact of "FANG" stocks on US market valuation and the relative re-rating of growth and quality stocks compared to those labelled as "value" (all labels we don't necessarily agree with - why can't a stock be good quality and good value because off its growth?), thanks to Yardeni Research, Gavekal and SG.

Percentage of years in which a market features a 10% sell-off

Source: Alpha Architect

Percentage of the time that a 5% sell-off becomes 20%

Source: Alpha Architect

High yield default rates of 7.5% or higher were joined by a median -23% purge in the market value of US equities from their previous high

Source: Moody's

Short interest in the ASX travel sector has increased

Source: Morgans

The biggest challenges facing real estate investors in 2020

Source: CBRE

S&P 500 Forward PE with and without "FANG" or "FAANGM" stocks

Source: Refinitiv, Yardeni Research

Relative valuation of "growth" v "value" in the US - based on earnings yield

Source: Gavekal

"Quality" stocks re-rated relative to "value" stocks

Source: SG Cross Asset Research