Ten Thousand Words: November 2019

Apparently, Confucius didn’t say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

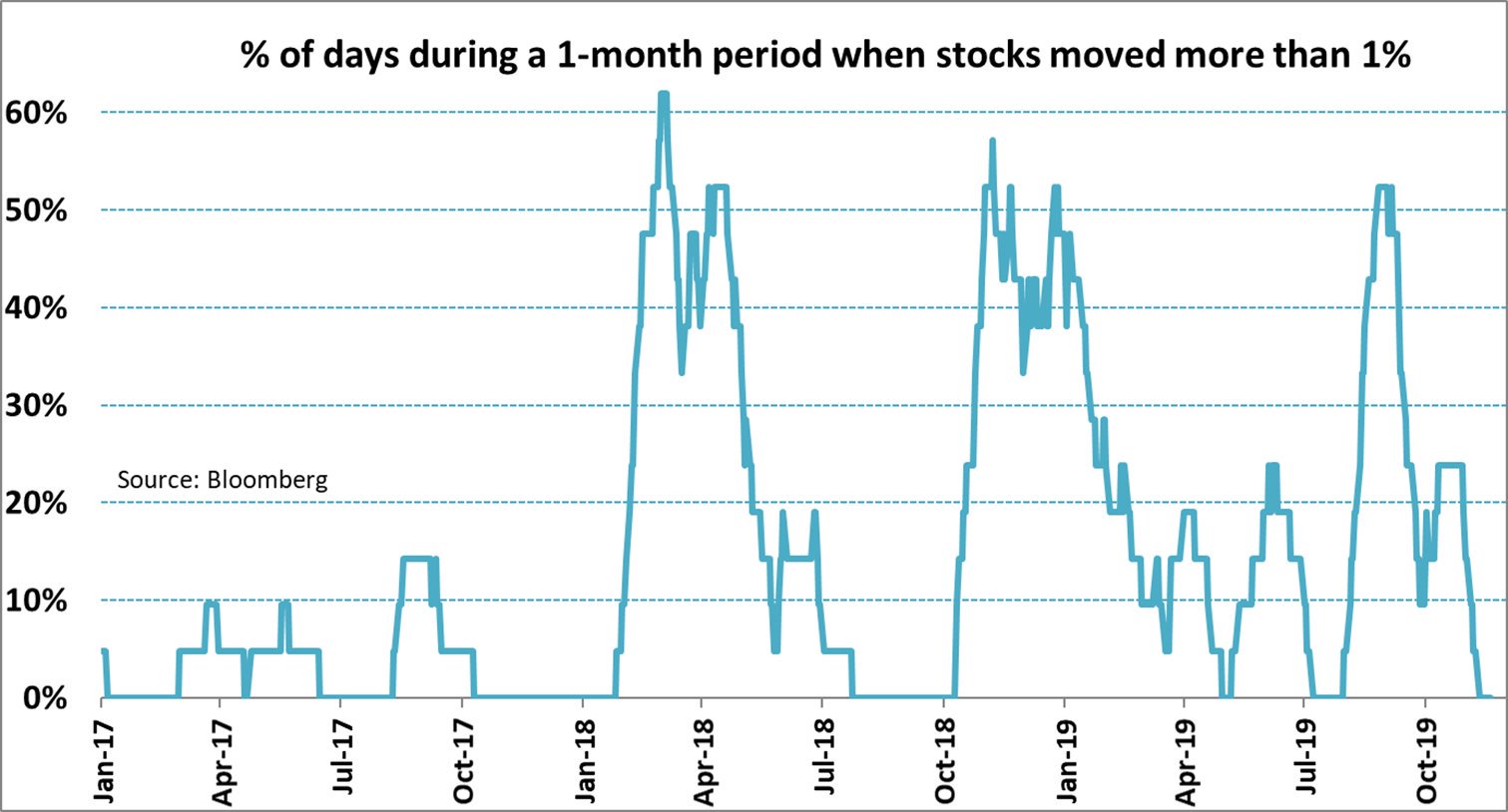

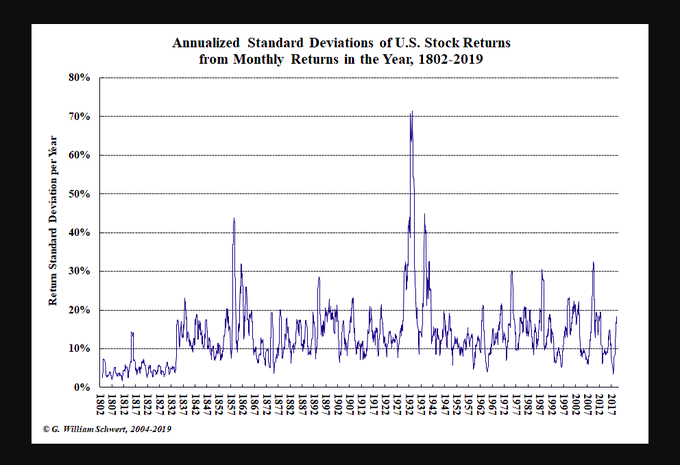

Volatility has been on strike recently as demonstrated by Robeco's JS Blokland and the % of days US equities have fallen more than one percent. But WSJ's Jason Zweig illustrated how volatility is volatile, at least historically. In this low inflation environment, Antipodes has called out a "bubble in duration" arguing that equities are increasingly behaving like bonds. Yet, at the same time, Crescat Capital chimes in with a chart showing that US EPS growth is now falling behind the modest inflation levels. And finally, AQR sets out the case for "value" to return to favour, finding it to be "the cheapest it's ever been" - "if the tech bubble isn't around the corner again".

% of days in 1-month period where US stocks moved more than 1%

Source: Robeco (@js blokland)

Annual standard deviation of US stock returns since 1802

Source: William Schwert via @jasonzweigwsj

Debt at non-financial firms with weak fundamentals as a % of GDP

Source: Antipodes Partners

US equity earnings v. inflation

Source: Crescat Capital

Spread between cheap and expensive portfolios using four valuation measures

Source: AQR

Volatility has been on strike recently as demonstrated by Robeco's JS Blokland and the % of days US equities have fallen more than one percent. But WSJ's Jason Zweig illustrated how volatility is volatile, at least historically. In this low inflation environment, Antipodes has called out a "bubble in duration" arguing that equities are increasingly behaving like bonds. Yet, at the same time, Crescat Capital chimes in with a chart showing that US EPS growth is now falling behind the modest inflation levels. And finally, AQR sets out the case for "value" to return to favour, finding it to be "the cheapest it's ever been" - "if the tech bubble isn't around the corner again".

% of days in 1-month period where US stocks moved more than 1%

Source: Robeco (@js blokland)

Annual standard deviation of US stock returns since 1802

Source: William Schwert via @jasonzweigwsj

Debt at non-financial firms with weak fundamentals as a % of GDP

Source: Antipodes Partners

US equity earnings v. inflation

Source: Crescat Capital

Spread between cheap and expensive portfolios using four valuation measures

Source: AQR