Ten Thousand Words - April 2019

Apparently, Confucius didn’t say “One Picture Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

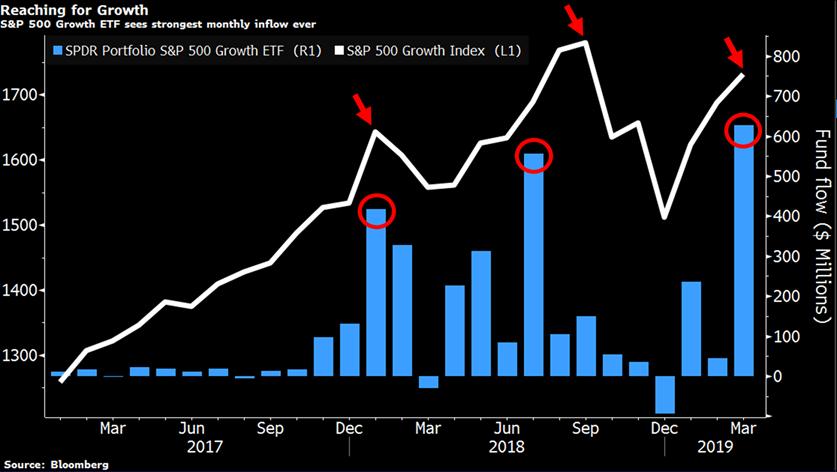

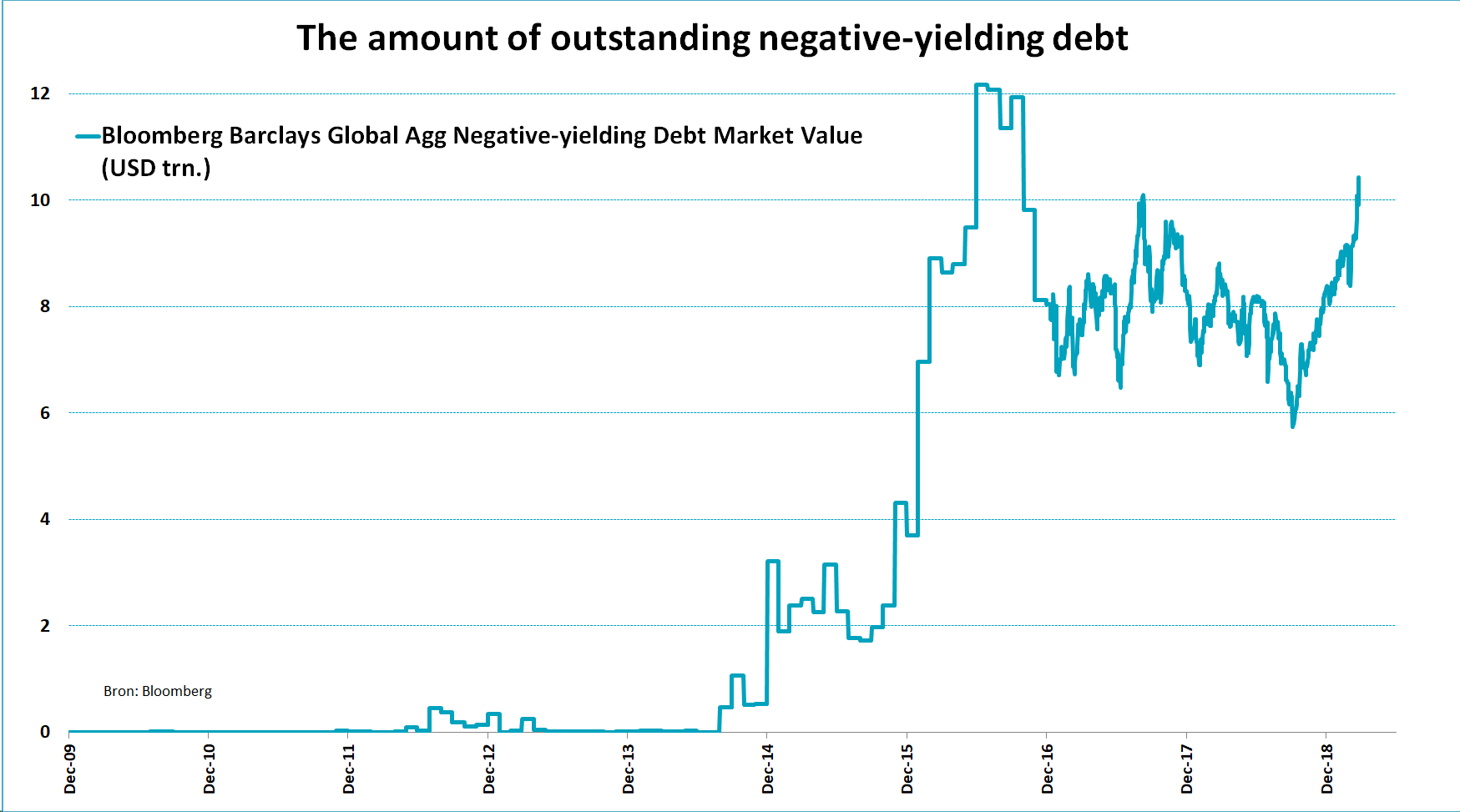

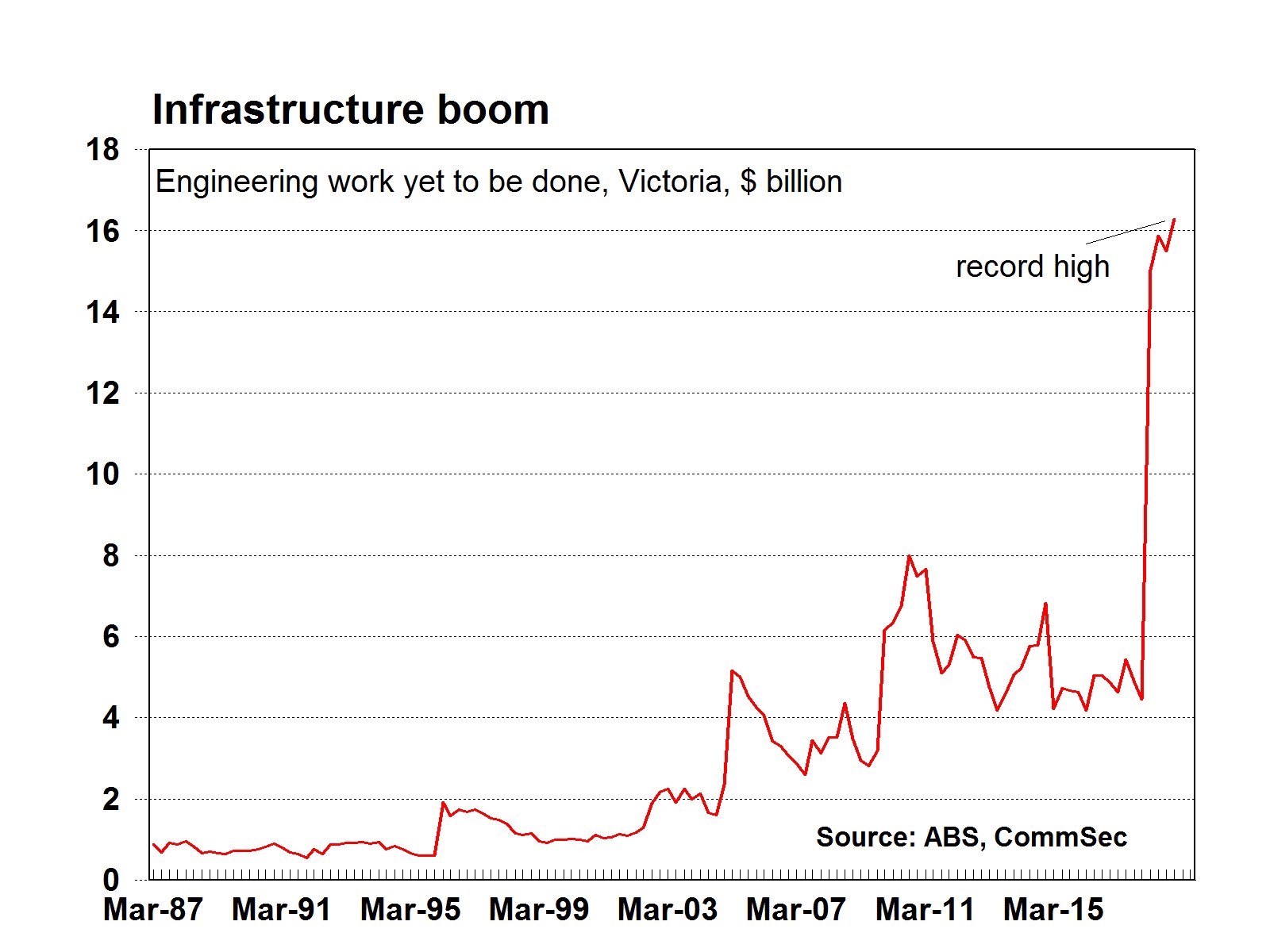

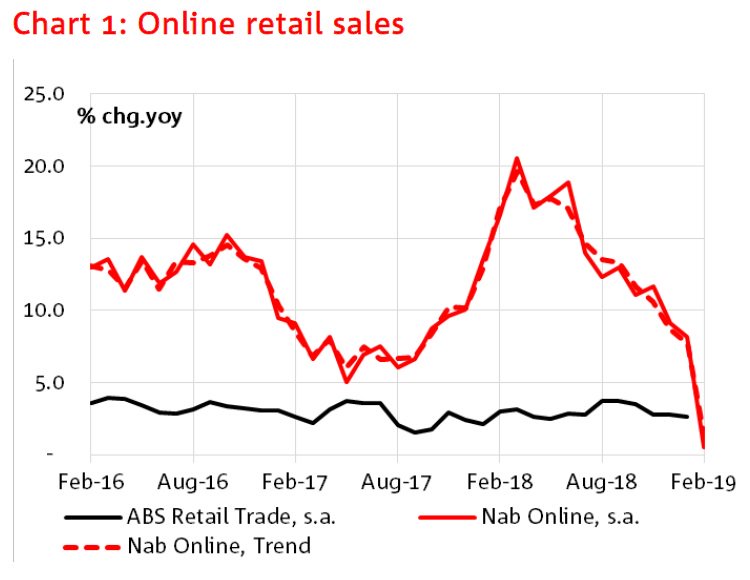

In the wake of the Lyft IPO, VC investor Josh Wolfe shows us that 63 companies were valued over $1 billion at IPO in the US, 50% were profitable in the year before IPO; Crescat Capital highlights record flows into a key US equities ETF and Blue Mountain Capital Management shows us why this may be a negative signal - investors expect high returns after realizing high returns (and expect low returns after realizing low returns) but reality runs counter to those expectations; meanwhile Robeco's Jeroen Blokland highlights that investors continue to pour money into negative yield debt (to be clear, that means they are paying the borrower); turning to industry we see streaming services taking the lead over pay TV in the US and the state of Victoria leading an infrastructure boom in Australia; and lastly, National Australia Bank documents a decline in the previously-reliable year-on-year growth of online sales.

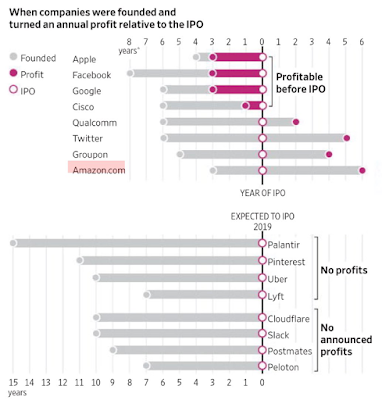

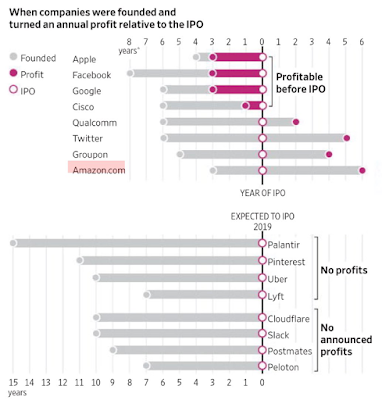

Who needs earnings to underpin an IPO?

Source: @wolfejosh

Household weighting to equities & future stock returns

Victoria leads Australian infrastructure boom

In the wake of the Lyft IPO, VC investor Josh Wolfe shows us that 63 companies were valued over $1 billion at IPO in the US, 50% were profitable in the year before IPO; Crescat Capital highlights record flows into a key US equities ETF and Blue Mountain Capital Management shows us why this may be a negative signal - investors expect high returns after realizing high returns (and expect low returns after realizing low returns) but reality runs counter to those expectations; meanwhile Robeco's Jeroen Blokland highlights that investors continue to pour money into negative yield debt (to be clear, that means they are paying the borrower); turning to industry we see streaming services taking the lead over pay TV in the US and the state of Victoria leading an infrastructure boom in Australia; and lastly, National Australia Bank documents a decline in the previously-reliable year-on-year growth of online sales.

Who needs earnings to underpin an IPO?

Source: @wolfejosh

Huge flows into S&P 500 ETF

Source: Crescat Capital

Household weighting to equities & future stock returns

Source: Blue Mountain Capital Management

Negative-yielding debt boom

Source: Robeco

Streaming Services Take the Lead in the US

Source: Statista

Victoria leads Australian infrastructure boom

Source: CommSec

Australian online retail sales growth dissipates

Source: CommSec