Ten Thousand Words - October 2018

Apparently, Confucius didn’t say “One Picture Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

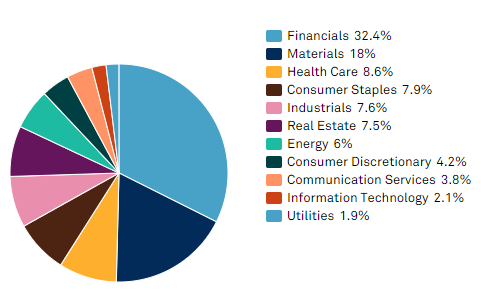

This month, Grandeur Peak shows that the benchmark return can be reliant on just a handful of stocks, while JP Morgan reminds us that when you've really picked the wrong stock, its a long way back. Checking in on S&P/ASX 200 weightings, we see that the financials and materials sectors are just over half of the market benchmark. Cannabis stocks, meanwhile, continue to be favourites with traders and the Wall Street Journal sets out some stark valuation comparisons. And research into private equity deals shows that its increasingly normal for deals such as the transaction this week where accounting software firm MYOB's private equity backer sold to a competing private equity firm.

Financials and Materials make up just over half the S&P/ASX 200

Source: S&P (as of September 28, 2018)

How highflying Canadian cannabis companies stack up with select US companies

Source: FactSet, WSJ

This month, Grandeur Peak shows that the benchmark return can be reliant on just a handful of stocks, while JP Morgan reminds us that when you've really picked the wrong stock, its a long way back. Checking in on S&P/ASX 200 weightings, we see that the financials and materials sectors are just over half of the market benchmark. Cannabis stocks, meanwhile, continue to be favourites with traders and the Wall Street Journal sets out some stark valuation comparisons. And research into private equity deals shows that its increasingly normal for deals such as the transaction this week where accounting software firm MYOB's private equity backer sold to a competing private equity firm.

In the June quarter "only eight stocks made up 100%" of the MSCI All-country World Investible Market Index return

Source: Grandeur Peak Funds

Percentage gain required to fully recover from a loss

Source: JP Morgan

The PE multiples of the ASX's most expensive decile of stocks at 17 year highs

Source: Evans & Partners

Financials and Materials make up just over half the S&P/ASX 200

Source: S&P (as of September 28, 2018)

Source: FactSet, WSJ

Pass-the-parcel - sales from one private equity firm to another

Source: FT