Aussie large caps haven't done so great in USD

Large cap Australian stocks appear at first glance to have held up better than global benchmarks in the latter half of the financial year.

While the S&P/ASX 200 has risen to its highest levels since the GFC, globally the Wall Street Journal recently published a chart illustrating that there had been a nearly $US10 trillion decline in world exchange market capitalisation since a peak in January 2018. The Russell 3000, a broad index of US stocks, peaked on January 31 and has pulled back ~4.5% since then.

MSCI itself reported that its Australia Index has declined by 1.18% in US dollars in the six months to the end of June, 2018, compared to a 0.76% gain for the MSCI World index. The Australian dollar variant of the same MSCI Australia Index gained 4.61%.

While the S&P/ASX 200 has risen to its highest levels since the GFC, globally the Wall Street Journal recently published a chart illustrating that there had been a nearly $US10 trillion decline in world exchange market capitalisation since a peak in January 2018. The Russell 3000, a broad index of US stocks, peaked on January 31 and has pulled back ~4.5% since then.

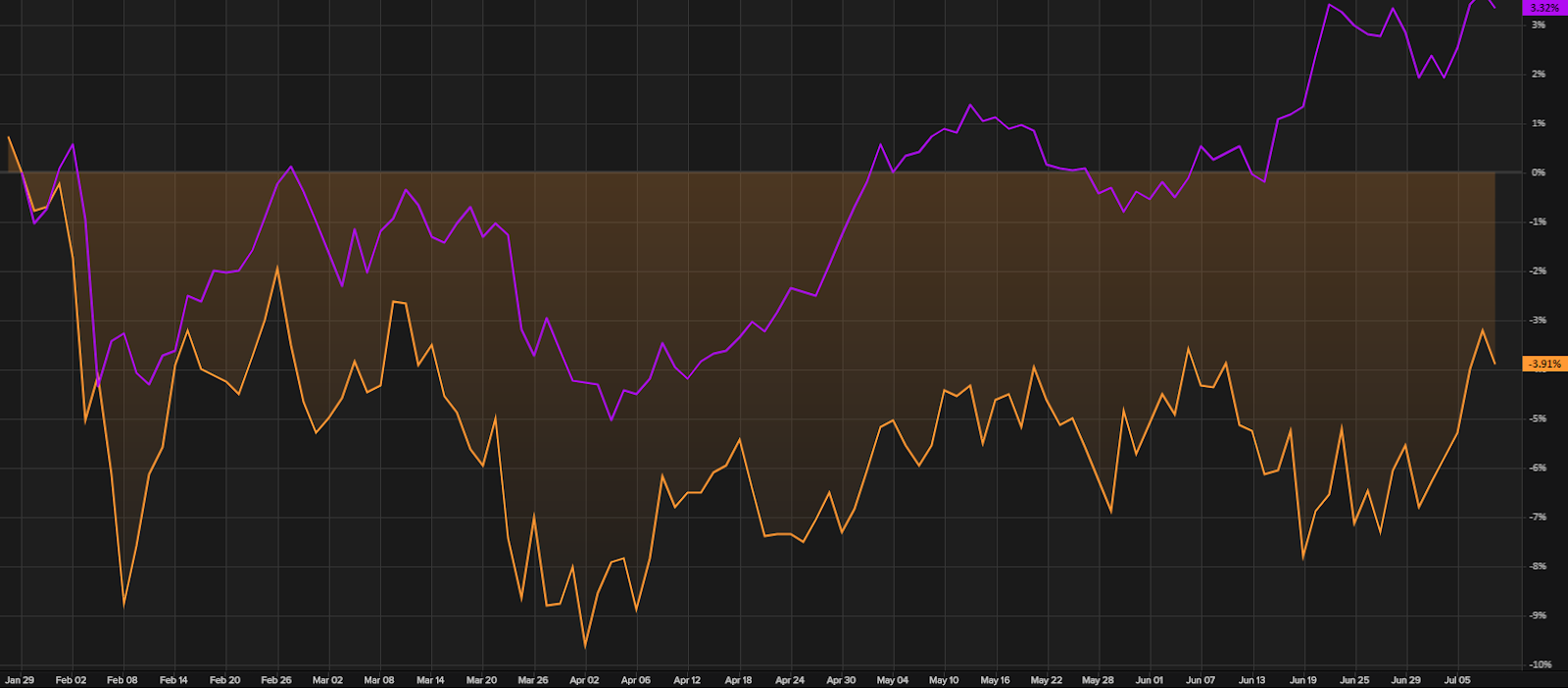

But once you consider exchange rate movements, you can argue that Australian equities haven’t performed so well. Figure 1 shows that from a US dollar perspective, Australian large cap equities have declined since late January. Note the AUD peaked at $US0.81 in Jan and is now ~ $US0.74.

Figure 1: iShares’ US-listed MSCI Australia ETF (USD, orange) v iShares’ ASX-listed S&P/ASX 200 ETF (AUD, purple)

Source: Thomson Reuters

MSCI itself reported that its Australia Index has declined by 1.18% in US dollars in the six months to the end of June, 2018, compared to a 0.76% gain for the MSCI World index. The Australian dollar variant of the same MSCI Australia Index gained 4.61%.

Estimates of US dollar fund flows suggest that money had been flowing into Australia pretty consistently - until mid June, as illustrated in Figure 2, below.

Figure 2: Weekly equity flows into or out of Australia

Source: EPFR Global, Financial Times