Fundamental anomalies are better explained by mispricing

If you've read our "Seeking Advantage" paper (available here) you would know that Equitable Investors believes in fundamental inefficiencies in equities markets. And those views were reconfirmed by a piece of academic research that considered over 18,000 fundamental signals, concluding that:

Consistent with our view, the research finds evidence consistent with the expectation that "the predictive ability of fundamental signals is more pronounced among small stocks".

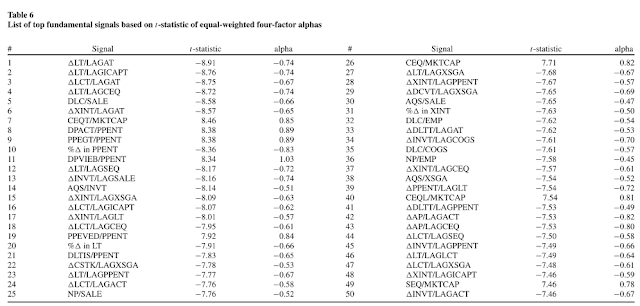

The top-ranked signal is change in LT/LAGAT (change in total liabilities divided by lagged total assets), with a monthly alpha of −0.74%.

List of top fundamental signals based on t-statistic

source: Fundamental Analysis and the Cross-Section of Stock Returns: A Data-Mining Approach

We won't translate all the abbreviations in the table above but we're sure you can work them out.

- "many fundamental signals are significant predictors of cross-sectional stock returns"

- "This predictive ability is more pronounced following high-sentiment periods and among stocks with greater limits to arbitrage"

- "fundamental-based anomalies, including those newly discovered in this study, cannot be attributed to random chance, and they are better explained by mispricing"

The research paper, "Fundamental Analysis and the Cross-Section of Stock Returns: A Data-Mining Approach" can be found on the University of Missouri website (here) or you can read a summary from CFA Institute (here).

Consistent with our view, the research finds evidence consistent with the expectation that "the predictive ability of fundamental signals is more pronounced among small stocks".

The top-ranked signal is change in LT/LAGAT (change in total liabilities divided by lagged total assets), with a monthly alpha of −0.74%.

List of top fundamental signals based on t-statistic

source: Fundamental Analysis and the Cross-Section of Stock Returns: A Data-Mining Approach

We won't translate all the abbreviations in the table above but we're sure you can work them out.