Ten Thousand Words - September 2019

Apparently, Confucius

didn’t say “One Picture is Worth Ten Thousand Words” after all. It was an

advertisement in a 1920s trade journal for the use of images in

advertisements on the sides of streetcars. Even without the credibility

of Confucius behind it, we think this saying has merit. Each month we

share a few charts or images we consider noteworthy.

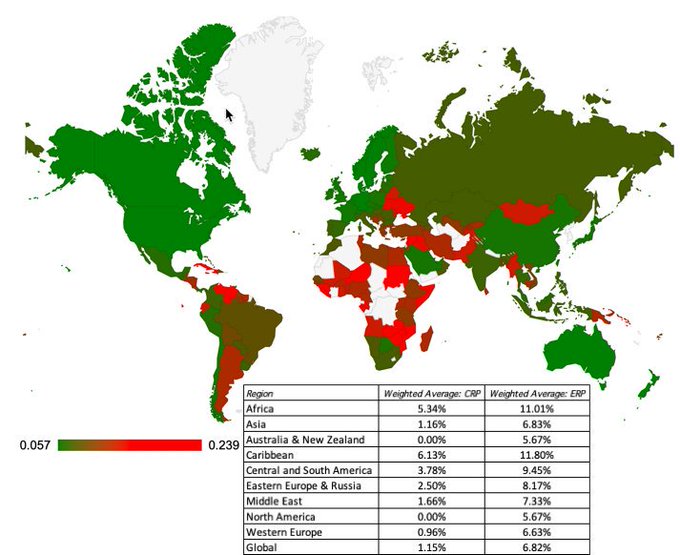

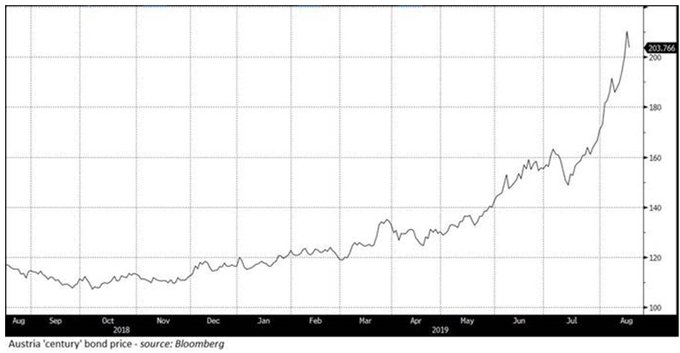

Aussie equities haven't been in vogue judging by the EPFR Global measurement of cross-border fund flows. Yet the Australian equity risk premium is adjudged to be on-par with the US by valuation guru Aswath Damodaran. Are bonds in a bubble? Investors doubled their money in a couple of years, as BGC Partners highlighted, by buying 100-year Austrian government bonds with a coupon of 2.1% that has since traded up in price to a 0.66% yield. Looking at valuations, high growth Software-as-a-Service (SaaS) stocks have recently pulled back from peak valuations, as illustrated by tomtunguz.com, while PZENA Investment Management shows that essentially all the expansion in the Price/Earnings multiple of the US market occurred in the most expensive quartile of stocks. Back home in Australia, UBS suggests the discount in small caps may imply it is time to overweight. And what does it mean if valuations remain high relative to historical measures but CEOs (in the US) are not as confident as set out by Crescat Capital? Finally, don't believe the noise about the superiority of private equity returns over public market returns as academic Erik Stafford's work shows.

Aussie equities not getting much love - weekly flows in US dollars

Aussie equity risk premium in-line with US at 5.67% according to Aswath Damodaran

Source: aswathdamodaran.blogspot.com

Investors doubled their money in a couple of years by buying 100-year Austrian government bonds

Source: BGC Partners

Forward Enterprise Value / Forecast Revenue for listed US SaaS Companies

Aussie equities haven't been in vogue judging by the EPFR Global measurement of cross-border fund flows. Yet the Australian equity risk premium is adjudged to be on-par with the US by valuation guru Aswath Damodaran. Are bonds in a bubble? Investors doubled their money in a couple of years, as BGC Partners highlighted, by buying 100-year Austrian government bonds with a coupon of 2.1% that has since traded up in price to a 0.66% yield. Looking at valuations, high growth Software-as-a-Service (SaaS) stocks have recently pulled back from peak valuations, as illustrated by tomtunguz.com, while PZENA Investment Management shows that essentially all the expansion in the Price/Earnings multiple of the US market occurred in the most expensive quartile of stocks. Back home in Australia, UBS suggests the discount in small caps may imply it is time to overweight. And what does it mean if valuations remain high relative to historical measures but CEOs (in the US) are not as confident as set out by Crescat Capital? Finally, don't believe the noise about the superiority of private equity returns over public market returns as academic Erik Stafford's work shows.

Aussie equities not getting much love - weekly flows in US dollars

Source: FT.com, EPFR Global

Aussie equity risk premium in-line with US at 5.67% according to Aswath Damodaran

Source: aswathdamodaran.blogspot.com

Investors doubled their money in a couple of years by buying 100-year Austrian government bonds

Source: BGC Partners

Forward Enterprise Value / Forecast Revenue for listed US SaaS Companies

Source: tomtunguz.com

PE multiple expansion in the US has largely been contained to the most expensive quartile of stocks

Widening small cap PE discount on the ASX suggests it could be time for them to outperform

CEO Confidence Index in the US Economy relative to the S&P 500

A replicating portfolio of low EV/EBITDA multiple stocks v the CA Private Equity Index pre-fees

Source: "Replicating Private Equity with Value Investing, Homemade Leverage, and Hold-to-Maturity Accounting", Erik Stafford