10k Words | July 2022

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

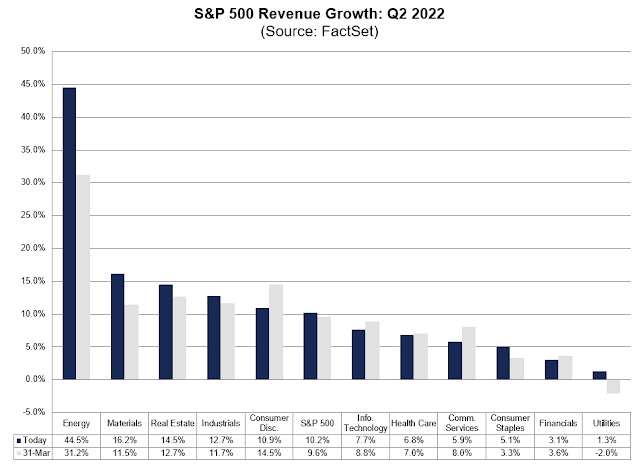

Revenue multiples have returned to pre-2020 levels for high growth software companies, based on Octahedron's index. The dowturn in valuations was accompanied by a 23% year-on-year decline in March quarter VC funding for late-stage and technoology growth funding, crunchbase calculated - although it found seed and angel investment held up better, growing 9% year-on-year. The Information found VC firms buying listed tech stocks, meanwhile consensus data from FactSet shows the tech sector is not expected to have been among the strongest growth areas of the S&P 500 in the June quarter - energy and materials stocks have the most expected of them. Kailash Capital shows that price growth for the S&P 500 in the 2017-2021 period has doubled the long-term average return. Finally, Bloomberg charts the rise of self-employment in the US.

Octahedron Growth Software Index (EV / NTM Rev)

Source: Octahedron

Global Venture Dollar Volume by quarter

Source: Crunchbase

Global Seed and Angel Investment by quarter

Source: CrunchbaseVC Firms Buying Publicly Listed Shares

Source: The Information

S&P 500 Revenue Growth Expectations

Source: FactSet

S&P 500 historical average returns

Source: Kailash Capital

Americans increasingly shifting to self-employment

Source: Bloomberg

.png)