10k Words - December 2021

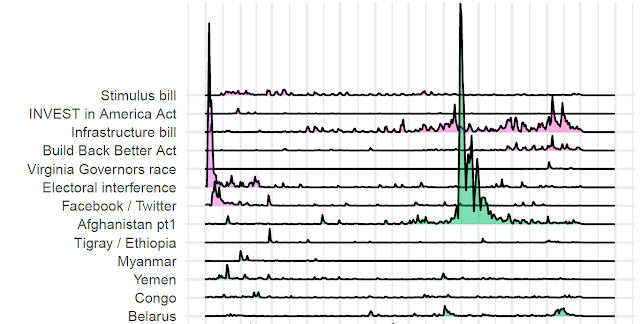

Apparently , Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy. Our final 10k Words for CY2021 kicks off with The Economist's first cut on what events captured audience attention in the media during the year. We then range across Morgan Stanley's chart on China property sector's importance to commodities, the surge in VC investment in cryptocurrency startups illustrated by The Economist and Bloomberg's ranking of countries through time based on their COVID-19 vaccine penetration. We get into equities with Bespoke showing ETFs don't necessarily fulfill the diversification function that is expected of them and finally Equitable Investors' analysis of what has worked and what h...