10k Words - December 2020

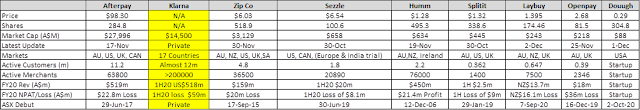

Apparently , Confucius didn’t say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy. Lets start with Buy Now Pay Later (BNPL - and you can watch Equitable Investors' Martin Pretty and Cyan's Dean Fergie recent chat about BNPL here ) - with Wilsons running the comps on the eight ASX listings in the space (how many do we need?). While the Robinhood investors remain in focus, data on US equities ownership shows those aged under 54 own less of the equity "pie" now than in past decades. If Deutsche Bank projections on COVID-19 immunity in wealthy nations prove correct, herd immunity is on its way in 2021. Morgan Stanley says global GDP will be back on trend in the next six months. And globally fund manage...