10K Words - March 2022

Apparently, Confucius did not say “One Picture is Worth Ten Thousand Words” after all. It was an advertisement in a 1920s trade journal for the use of images in advertisements on the sides of streetcars. Even without the credibility of Confucius behind it, we think this saying has merit. Each month we share a few charts or images we consider noteworthy.

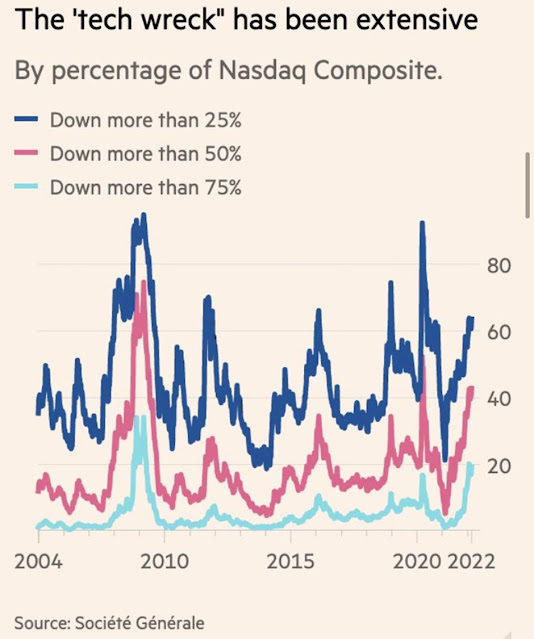

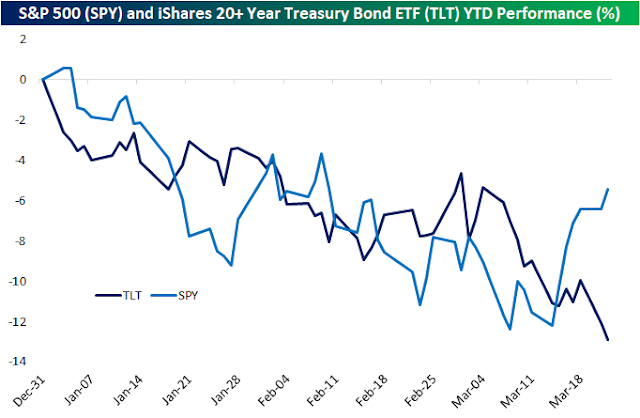

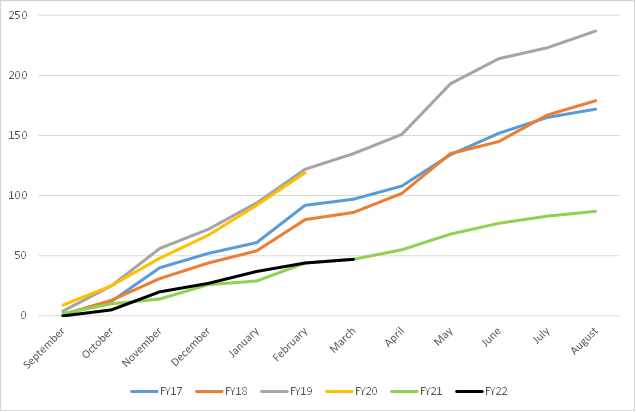

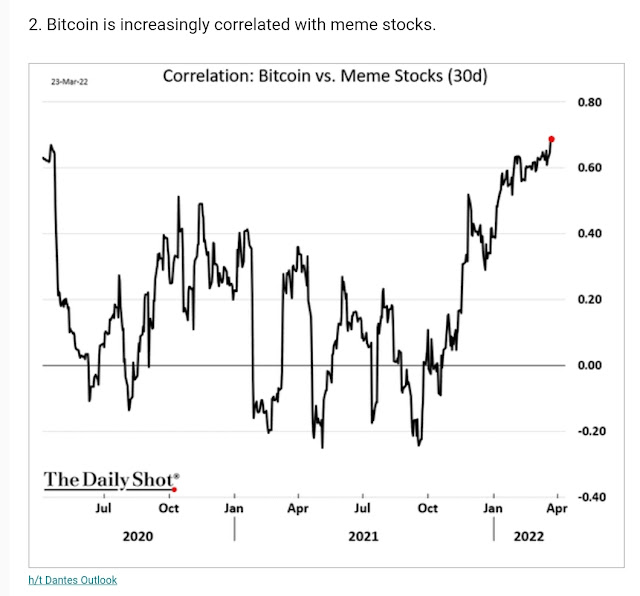

The extent of the new "Tech Wreck" is highlighted by Societe Generale with 60%+ of stocks in the index down more than 25%, including 20% down more than 75%. But bonds have not delivered on their promise of safety as Bespoke and The Irrelevant Investor highlight. Back in Australia, Wilsons counts only 47 earnings downgrades in total for FY22 (so far), which is similar to FY21 but well below pre-Covid years. Wilsons also shows an unusually large spread between growth in small and large caps. The correlation of bitcoin with the more speculative parts of the equities market has been mapped courtesy of The Daily Shot. Finally, Bloomberg highlights that Australian polling indicates a change of federal government is on the cards.

Nasdaq's latest "tech wreck"

Source: Societe Generale, @jsblokland

US equities (S&P 500) v long-term bonds (iShares 20+ Year Treasury Bond)

Source: Bespoke

Bond market drawdowns: US equities (S&P 500) v Vanguard Total Bond Market ETF

Source: The Irrelevant Investor

Number of ASX downgrades per financial year

Source: Wilsons

ASX large cap growth less small cap growth

Source: WilsonsBitcoin correlation with "meme" stocks

Australia's election polls pointing to change in government

Source: Bloomberg, Newspoll